Donate up to $421 for Single or Head of Household tax filings, or up to $841 if married filing jointly, and receive a dollar for dollar tax credit for your contribution.

New limits for 2023 & 2024:

The maximum QCO credit donation amount for 2023:

$421 single, married filing separate or head of household; $841 married filing jointly.

The maximum QCO credit donation amount for 2024:

$470 single, married filing separate or head of household; $938 married filing jointly.

It’s as easy as clicking donate on this page or in the menu, and then claiming the tax credit when you file your taxes. Learn more about how the tax credit works in Arizona.

See how your money will be used to fight poverty.

How does it help?

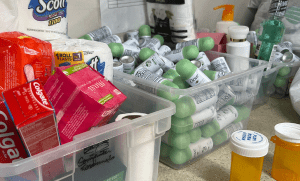

Provide Clothing for Low Income Families

Give Someone a Boost during Difficult Times with a Food Box.