Thank you for your donation! Federal Tax ID/EIN #: 86-0401223

State QCO/Tax Credit ID: 20385

New maximum QCO credit donation amount for 2025:

$495 single, married filing separate or head of household

$987 married filing jointly

How it works:

The State of Arizona has a unique program that allows you to decide where you want your tax dollars to go for charitable purposes. NourishPHX is a Qualified Charitable Organization (QCO) for the Arizona Charitable Tax Credit that gives you the opportunity to donate to NourishPHX (see limits above) and receive a dollar-for-dollar tax credit. Our QCO code is 20385.

*For example, if a single individual owes $1000 in taxes but donates $400 to a qualifying charitable organization, their tax liability is reduced to $600.

How NourishPHX uses your gift: Your donation will clothe, feed and provide employment support to more than 20,000 individuals that are served each year, 30% being children!

Step-by-step: how to donate:

There are four (4) steps to document your donation and claim your tax

credits:

• Donate to a certified charitable organizationn (QCO), such as NourishPHX, a 501c3 charitableorganization.

• Maintain a receipt of your gift from the charity, in order to provide a copy with your tax filings

• Complete Arizona Form 321 to claim your credit for your gift(s) or notify your tax advisor that you have made a Charitable Tax Credit Donation and give them our QCO code: 20385.

• Calculate your individual tax return (e.g. Arizona Form 140, 140NR, 140PY or 140X), subtracting your tax credits from your tax liability, in order to reduce your Arizona state tax.

Due Dates: The state of Arizona allows taxpayers to claim tax credits for gifts through April of the current year for the prior tax year.

If you would like to read more about the Arizona Charitable Tax Credit visit the Arizona Department of Revenue, or consult a qualified tax professional for personal tax advice. For questions about your donation, please contact our Development Coordinator.

See how your money will be used to fight poverty.

How does it help?

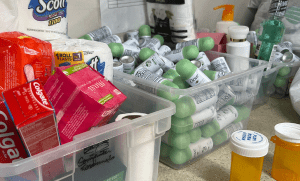

Provide Clothing for Low Income Families

Give Someone a Boost during Difficult Times with a Food Box.